India’s smartphone market inched forward in the first half of 2025, with shipments touching 70 million units and registering just 0.9% year-over-year growth, according to IDC’s latest Worldwide Quarterly Mobile Phone Tracker. The rebound, after two sluggish quarters, was helped by a lively second quarter that saw 37 million units shipped, a 7.3% YoY jump, but analysts warn the momentum may not last.

In This Article

Premium segments shine while budget phones struggle

Average selling prices (ASPs) climbed to an all-time high of $275 (around Rs 23,000) in Q2 2025, up 10.8% from last year. The premium (US$600–US$800) category was the fastest-growing, surging 96.4% YoY, thanks to models like the iPhone 16 and Galaxy S25. Meanwhile, the super-premium ($800+) segment grew 15.8%, with Samsung narrowly edging out Apple for the top spot.

Read Also: Top 10 smartphones under Rs 30,000 (August 2025)

The story was very different at the bottom end of the market. While the entry-level segment (sub-$100) grew 22.9% in share to 16%, most budget-friendly Android models struggled to keep pace. The mid-budget ($100–$200) range slipped from 44% to 42% market share, and the entry-premium ($200–$400) segment saw shipments dip 2.5% YoY.

Brand leaders and risers

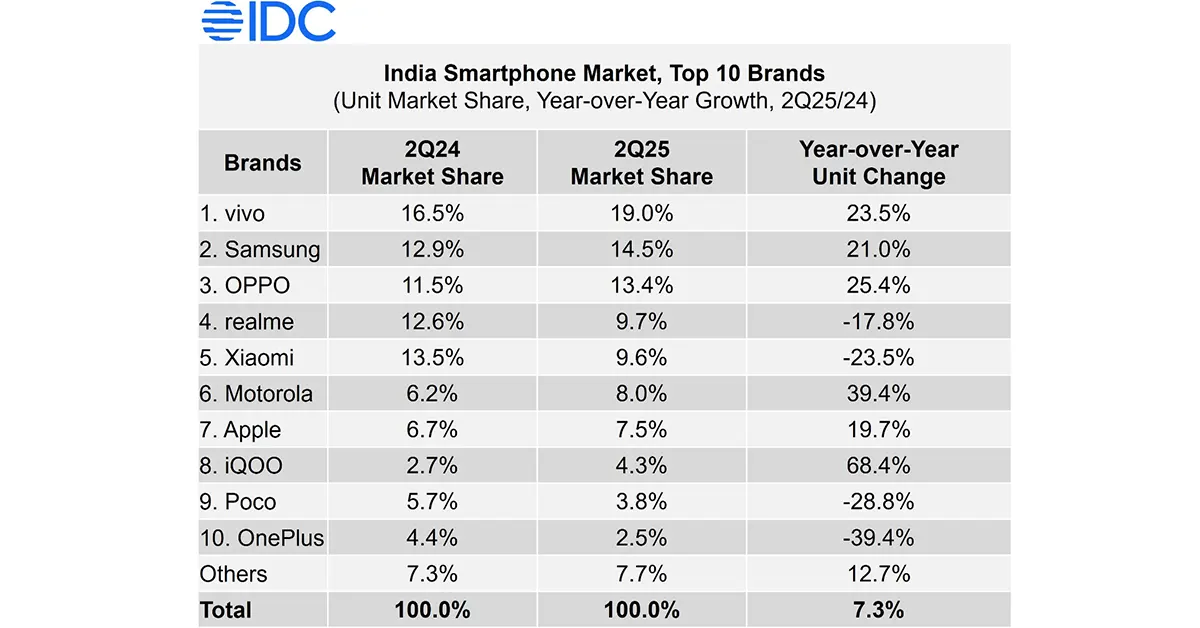

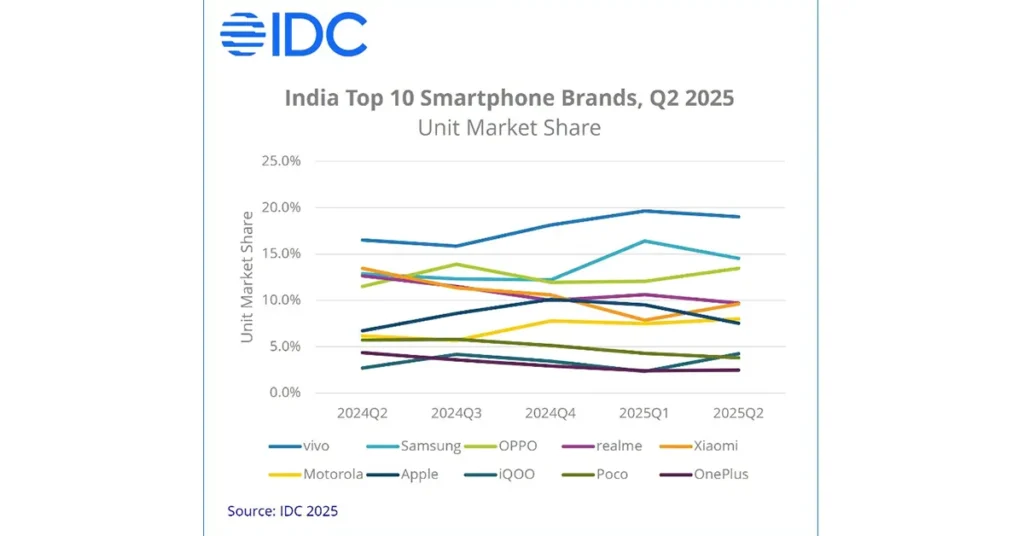

Vivo held onto its crown for the sixth straight quarter, commanding a balanced presence across segments and channels. Samsung followed closely, driven by new Galaxy A, M, and F series launches that brought AI-powered features to mid-range devices. Oppo’s focus on service accessibility and affordable launches like the K13 helped it secure third place.

Nothing grabbed headlines with a staggering 84.9% YoY shipment growth, followed by iQOO at 68.4%. Apple maintained its upward streak, shipping 5.9 million units in 1H25, a 21.5% YoY increase, with the iPhone 16 emerging as the single highest-shipped model in the country, capturing 4% of all smartphone shipments.

Chipset wars and channel shifts

The processor battlefield saw Qualcomm gaining ground, with shipments up 37.6% YoY and a 33.9% share. MediaTek’s share fell to 44.3% from 56.1% a year earlier, as shipments dropped 15.4%.

Offline sales channels are making a comeback, growing 14.3% YoY to account for 53.6% of shipments in Q2. Aggressive omnichannel strategies, higher retailer margins, and in-store promoters have helped brick-and-mortar retail regain momentum. E-tailers, not to be outdone, have countered with seasonal sales and deep discounts on premium devices.

Read Also: Vivo X Fold 5 Review: This is more than a phone; it’s a statement piece

What lies ahead

IDC projects a low single-digit decline in full-year smartphone shipments for 2025, citing rising ASPs and macroeconomic headwinds. The oversupply in the mid-range segment could create inventory headaches during the festive season, with analysts urging brands to prioritise fresh shipments over heavy discounting of old stock.

While the market’s growth may be modest, the shift toward premium and super-premium devices shows India’s smartphone story is no longer just about affordability. The real battle ahead is convincing the cautious middle-tier buyer to upgrade without waiting for a flash sale.