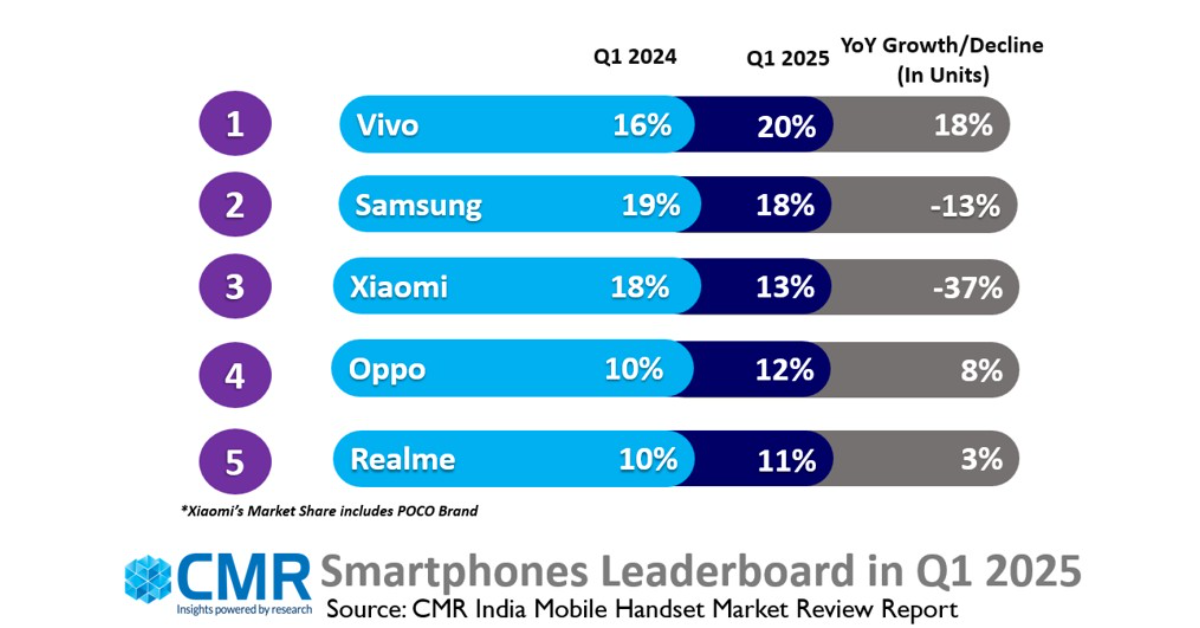

According to Cyber Media Research, the Indian smartphone market declined by 7% year on year in Q1 2025, with a 37% reduction in feature phone shipments. Vivo, a Chinese brand, ruled the market with a 20% share, with Samsung taking second place. Xiaomi, Oppo, and Realme maintained their top rankings, while iTel Mobile led the sector with a 37% YoY drop. Apple reported a 25% YoY increase, bolstering its position in the ultra and Uber-Premium classes.

According to a CyberMedia Research (CMR) analysis, India’s smartphone market fell by 7% YoY in Q1 2025 as customer tastes changed and competition grew. However, the higher-end sector expanded, thanks to high demand for 5G-enabled and AI-ready devices. 5G smartphone shipments accounted for 86% of the market, with 5G handsets priced between INR 8,000 and INR 13,000 witnessing 100% year-on-year growth.

Vivo now leads the market with a 20% share, with the Vivo Y29, T3 Lite, T3X, and T4X models accounting for 43% of 5G shipments. Samsung is second with 18%, although its value-for-money section has declined by 13% year on year. The S25 series has a significant presence in the premium Android category.

Xiaomi’s market share fell to third place, with a 37% YoY reduction, signalling issues in the affordable and value-for-money smartphone markets. OPPO’s 12% market share climbed by 8% year on year, while Motorola had 53% YoY growth, owing to significant product differentiation and a competitive 5G portfolio. Motorola has seen double-digit growth in six of the last seven quarters.

Also Read: Samsung Vision AI TV series, including Neo QLED, OLED, QLED, and The Frame, launched in India

Transsion Group had a 13% YoY loss owing to increased competition from low-cost smartphones. No substantial year-over-year increase was reported, with new arrivals such as Nothing Phone (3a) Pro and Nothing Phone (3a) adding to the Q1 2025 mix. MediaTek topped the Indian smartphone chipset market with 46%, while Qualcomm oversee the premium smartphone sector with 35%.

Apple had a 25% YoY rise and an 8% market share in India, owing to high demand for luxury devices and a larger retail presence. The iPhone 16 series, including the iPhone 16e, made a major contribution, with market share in the super-premium sector increasing by 28% year on year and the uber-premium segment increasing by 15%.

The affordable smartphone category (<INR 7,000) increased by 3% year on year, while the value-for-money segment (INR 7,000 – INR 25,000) decreased by 6%, indicating a trend towards luxury handsets.

As per the report in Q1 2025, the 2G feature phone segment was dominated by Itel Mobile (41%), Lava (31%) and HMD (19%).

Also Read: Tecno to rollout new HiOS 15 upgrade, to bring clean OS, Ella AI, and more

Commenting on the market dynamics, Menka Kumari, Senior Analyst at CyberMedia Research (CMR), said, “The <INR 10,000 5G smartphone segment witnessed over 500% YoY growth in Q1 2025. This reflects a strong consumer appetite for affordable 5G smartphones. Brands such as Xiaomi, POCO, Motorola, and Realme are leading this surge. On the other hand, the 2G feature phone segment fell 17% YoY, while 4G feature phones declined sharply by 66% YoY.”