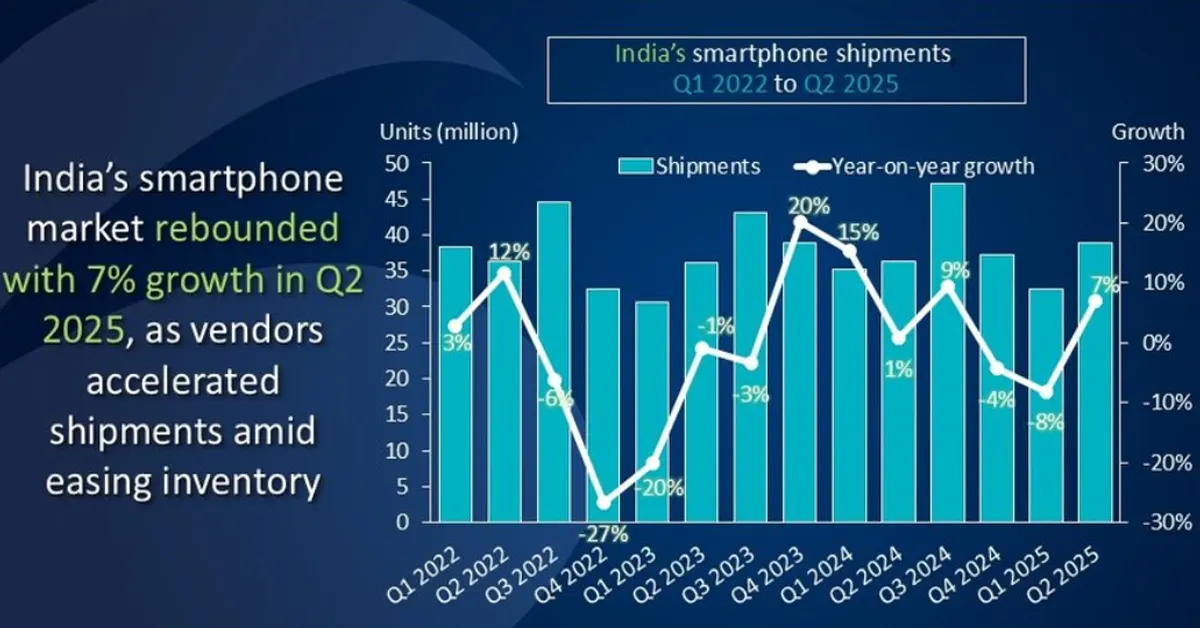

India’s smartphone market is ringing with optimism as Q2 2025 closes with a 7% year-on-year surge in smartphone shipments, according to Canalys (now part of Omdia). After an inventory-led sluggish start to the year, the country’s smartphone shipments hit 39 million units this quarter, propelled by India smartphone shipments Q2 2025—the hottest in the room. This bounce was thanks to a wave of new launches, creative channel incentives, and a retail shake-up that put the spotlight on both the usual titans and the ambitious challengers.

In This Article

Inventory Hangover to Fresh Fervour

The year didn’t start with a selfie; it started with a sigh. Elevated inventory levels had most brands holding back in Q1. But come Q2, brands turned the page with a burst of launches, clever festive planning, and some eyebrow-raising financing offers. Even the weather (brutal), US tariffs, and global uncertainties couldn’t keep Indian consumers away from their beloved upgrades.

Read Also: Top 10 smartphones under Rs 10,000 (July 2025)

The Race for the Top: Who’s Winning?

-

vivo (excluding iQOO) took the winner’s trophy, shipping 8.1 million units and snatching a robust 21% market share—up 31% from last year. Its V50 series worked wonders in Tier 1 and Tier 2 cities, boosted by wedding campaigns and glitzy retail partnerships. The Y-series didn’t miss a beat in smaller towns either.

-

Samsung clocked in at second, shipping 6.2 million units for a 16% share, flexing its EMI muscles in the mid-premium bracket (hello, zero-cost 18- and 24-month schemes).

-

OPPO surged to third place with 5 million units (13% share), while Xiaomi matched the shipment number but saw a sharp drop year-on-year. Xiaomi’s push was powered by the Redmi 14C 5G and Note 14 refreshes, but softer sentiment held it back.

- Advertisement - -

realme rounded off the top five, with 3.6 million units shipped, down 17% from last year.

Others—including Apple, Motorola, Infinix, and Nothing—are reshaping the leaderboard, each carving a niche with design-led innovation, bolder campaigns, and aggressive expansion in both urban and semi-urban zones. Notably, Nothing’s volumes soared 229% year-on-year, riding the buzz around its CMF Phone 2 Pro and new launches.

Market Moves: Incentives, Infrastructure, and Festive Fever

With organic demand feeling a bit, well, sluggish, brands are hustling harder on the channel front. Retailers are getting sweeteners, from foreign trips to vehicles, to move inventory during Monsoon, Durga Puja, and Diwali. Shop displays are looking smarter, promoter targets are stricter, and financing options are stretching longer to bring more mid-to-high-end models within reach.

Read Also: Whirlpool Intellifresh Pro 308L Review: Turns Up The Cool

In Q2 2025, affordability and visibility are the names of the game. Brands are betting on long-tenure EMI offers, spiffier stores, and aggressive in-store promotions to win hearts (and wallets) ahead of the festive sales.

What’s Next for 2025?

The outlook for H2 2025? Expect less of a blockbuster and more of a strategic dance. The big push will be on retail execution and sustained affordability, not just splashy product launches. Even with all this retail razzmatazz, Canalys (now Omdia) predicts a modest full-year decline, as structural demand challenges persist.

The Numbers Game: Q2 2025 vs Q2 2024

| Vendor | Q2 2025 Shipments (mn) | Q2 2025 Market Share | Q2 2024 Shipments (mn) | Q2 2024 Market Share | Annual Growth |

|---|---|---|---|---|---|

| vivo | 8.1 | 21% | 6.2 | 17% | +31% |

| Samsung | 6.2 | 16% | 6.1 | 17% | +2% |

| OPPO | 5.0 | 13% | 4.1 | 11% | +24% |

| Xiaomi | 5.0 | 13% | 6.7 | 18% | -25% |

| realme | 3.6 | 9% | 4.3 | 12% | -17% |

| Others | 11.0 | 28% | 8.9 | 25% | +23% |

| Total | 39.0 | 100% | 36.4 | 100% | +7% |

India’s smartphone market has mastered the art of the comeback, but the real plot twist lies in the evolving retail strategies and channel hustle. In 2025, the show belongs as much to the retail floor as to the launch stage. One thing’s for sure—this is a market that never fails to surprise.