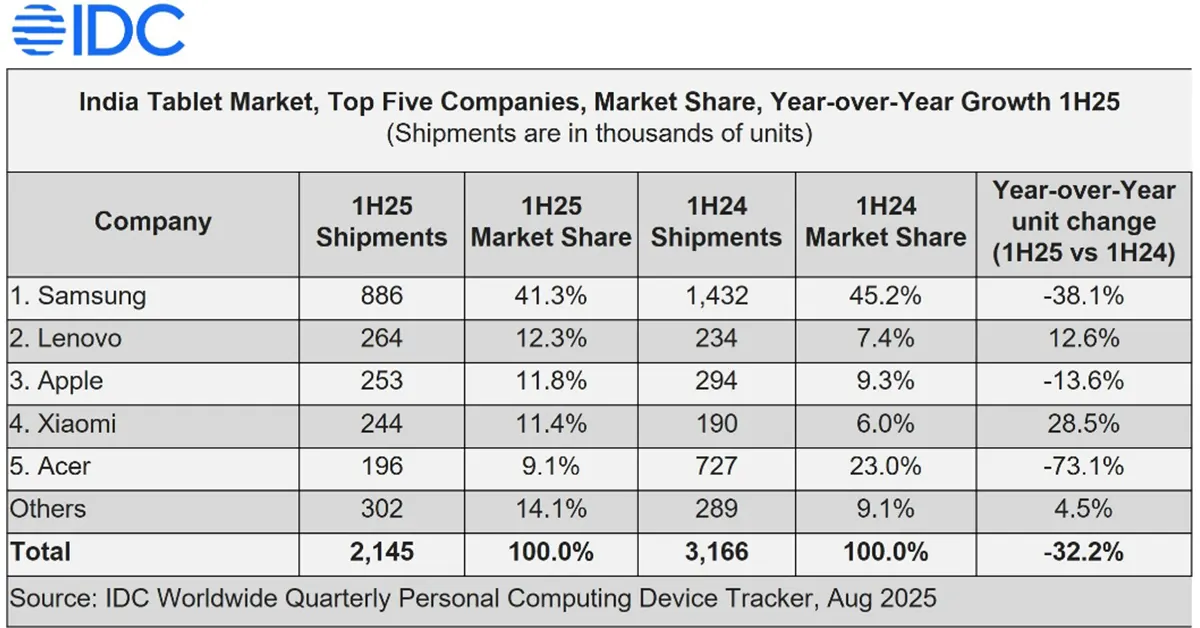

India’s tablet story just hit the brakes. In the Indian tablet market 1H25, shipments fell to 2.15 million units, a 32.2 per cent year-over-year slide. The drop worsened in Q2 with a 42.1 per cent decline after an 18.4 per cent fall in Q1, pointing to a rough first half for vendors and channels.

In This Article

The big picture

IDC’s tracker highlights a tale of two form factors. Detachable tablet growth clocked 18.9 per cent year over year, but slate tablets plunged 44.4 per cent, dragging the market into negative territory. The sharp contraction is linked primarily to weaker commercial buying after government-funded manifesto programs cooled, which historically prop up large deployments.

Read Also: Lenovo Legion Pro 7i, Legion 7i, Legion Pro 5i, and Legion 5i gaming laptops launched in India

Consumer vs commercial: a widening split

Shoppers kept tapping “add to cart.” The consumer tablet market rose 20.5 per cent in 1H25, helped by aggressive sell-ins, Amazon Prime Day, back-to-school offers, cashback deals and EMI options. Brand-owned stores and regional retail chains added momentum, as bigger screens, stylus support and affordable entry models swayed buyers.

On the flip side, commercial shipments tumbled 61.7 per cent. Education fell 66.7 per cent and enterprise was down 26.2 per cent, hit by paused tenders, SMB cost controls and limited refresh at large firms. Do not expect a quick bounce, given typical public sector refresh cycles.

Market leaders in 1H25

Who held shares while the market slid?

-

Samsung: 41.3 per cent overall. Led both commercial and consumer segments, supported by education projects and strong online inventory execution.

-

Lenovo: 12.3 per cent overall. Picked up in SMB and enterprise, plus gains via e-tailers.

-

Apple: 11.8 per cent overall. Solid 14.4 per cent in consumer; enterprise presence expanded.

-

Xiaomi: 11.4 per cent overall. Consumer growth of 28.5 per cent on a value-centric lineup.

-

Acer: 9.1 per cent overall. Down 73.1 per cent year over year due to cancelled education deals and softer enterprise demand.

This slump arrives right after a blockbuster 2024, when tablet shipments in India surged 42.8 per cent to 5.73 million units. That rebound was fueled by promotions, improved Android features and government education deployments. The pendulum has now swung, especially on the public side, exposing how dependent volumes can be on large institutional orders.

Why it matters for buyers and brands

-

Detachable tablet growth suggests users want flexible, laptop-adjacent devices without laptop prices.

-

Commercial tablet decline signals caution from schools, ministries and enterprises, which could pressure vendors to pivot toward consumer-friendly bundles.

-

Samsung tablet share leadership keeps pressure on rivals to differentiate on design, ecosystem and after-sales.

-

Consumer tablet demand remains resilient, so expect more stylus-ready, large-screen models at aggressive prices.

-

Expect more targeted marketing and timing around major e-commerce events.

Read Also: Vivo T4 Pro with a massive 6500mAh battery launched in India

IDC notes the consumer market doubled between 2019 and 2021 and could triple by end-2025, but public sector demand has eased with a three to four-year refresh cycle. That sets the stage for continued double-digit declines in commercial shipments even if households keep buying.

The tablet is not done. If detachables keep climbing and vendors keep pricing smart, the category may quietly reinvent itself as India’s go-to budget PC.